You Can Buy a Timeshare for $1 on the Resale Market, But Should You?

With $10 billion a year in timeshare purchases, (yes, billions!) Americans are spending more money buying vacation ownerships than Major League Baseball’s total annual revenue! This article, by a timeshare owner for other potential owners, will help you analyze timeshares for sale and make a purchase that’s a great value for money.

I’ve never worked in the timeshare industry and I’m not being compensated by any of the parties I talk about in this article – just a happy timeshare owner of 15 years. I’m on a mission to help the 20 million people (9 million in the U.S. alone!) who own a timeshare make the most of it. I’m Your Timeshare Fairy Godmother!

If you’re thinking to yourself “What is a Timeshare Exactly?!?” Timeshares are partial vacation ownerships of condo-like units in resort developments. They are owned, operated, and maintained by independent resorts, small chains, and large timeshare companies like Hilton Grand Vacations Club, Club Wyndham, Marriott Vacation Club, and Disney. You might have stayed in a timeshare rental before without realizing it!

Don’t Purchase on a Whim

Buying a timeshare is not the type of real estate decision to make on a whim, three margaritas deep, while on vacation. Can your budget–and your emergency fund—comfortably cover all of the costs every year? Even during job loss, retirement, or a pandemic? For more introductory information on timeshare ownership and factors to consider before making this long-term commitment check out “Six Tips for Savvy Timeshare Purchases.”

There are a variety of factors in selecting a timeshare company or vacation club, but for this article and analysis, I’m going to focus on value for money as the driver for analyzing timeshares for sale. Perhaps you are thinking about becoming a new timeshare owner and want to make a small, and smart, financial commitment. Or maybe you’re one of the 20 million timeshare or vacation club owners worldwide who are looking for more trips and you want to buy in a resort development with the most bang for your buck. Well, I got some great buys for you!

Value for Money Starts in the Timeshare Resale Market

When buying timeshares, the path to a savvy purchase starts by getting a timeshare resale from an existing owner who is looking for a timeshare exit. According to Timeshare Users Group (TUG), the oldest and largest timeshare owners group and advocacy organization, timeshare resorts spend between 40% – 60% of the purchase price on marketing campaigns to sell timeshare properties. Meaning, if you buy a vacation property directly from a timeshare resort you’ll be paying much more than its market value.

You can save 75 to 99% of the purchase price by buying in the resale market. TUG hits it right on the head when they say, “Why would anyone buy from a resort if they could get the exact same “used condo” week, at the exact same resort property, for pennies on the dollar from an existing owner?”

What is the Best Timeshare to Buy?

If I had a dollar for every time people ask this question in the owners’ groups and forums I am in, there’d be two brand new Teslas parked in our driveway. There are folklores out there on the top timeshare ownership resorts for value but I’ve never seen a comparative analysis. One legend is that Grandview, a Vacation Village Resort in Las Vegas, is THE timeshare that gives you the most value for the money. This article will explore this hypothesis and answer once and for all, Is Grandview the Granddaddy of Timeshare Value?

How to Evaluate Timeshares for Sale Across Companies: Apples & Oranges

The timeshare industry does not have an easy way to evaluate timeshares strictly based on value like the dollar per square foot metric when you’re looking to purchase real estate. To make matters more complicated, timeshare companies now offer a wide range of timeshare products (fixed week, points system, fractional ownership, deeded ownership, etc.) to meet people’s various vacation preferences.

So how do you figure out the best timeshare to buy for value if you’re trying to compare apples, to oranges, to pineapples to grapes? You compare the two common denominators for every single timeshare ownership resort: the trading power associated with what you’re buying and the maintenance fees you pay every year.

Where Can You Find Timeshares for Sale in the Resale Market?

One of the best places to find timeshare resale listings is TUG’s owner-to-owner marketplace. It is one of the largest and most visited timeshare classified ad sites on the internet with $30 million in timeshare sales, $18 million in owner direct timeshare rentals, and one-week vacation exchanges between timeshare owners. Who needs an expensive timeshare exit company when there is TUG? If you’re looking for a timeshare exit or a place for a timeshare rental, you don’t need a real estate company with high fees.

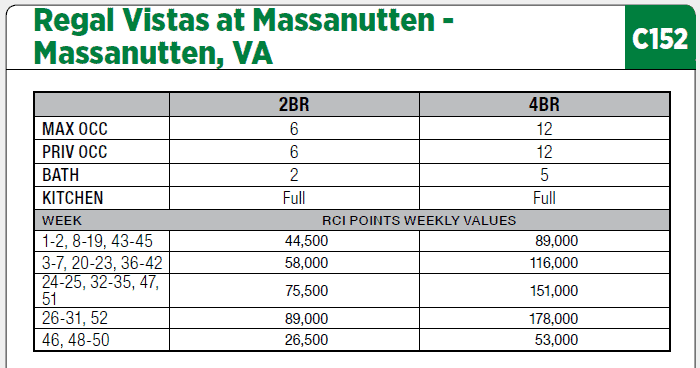

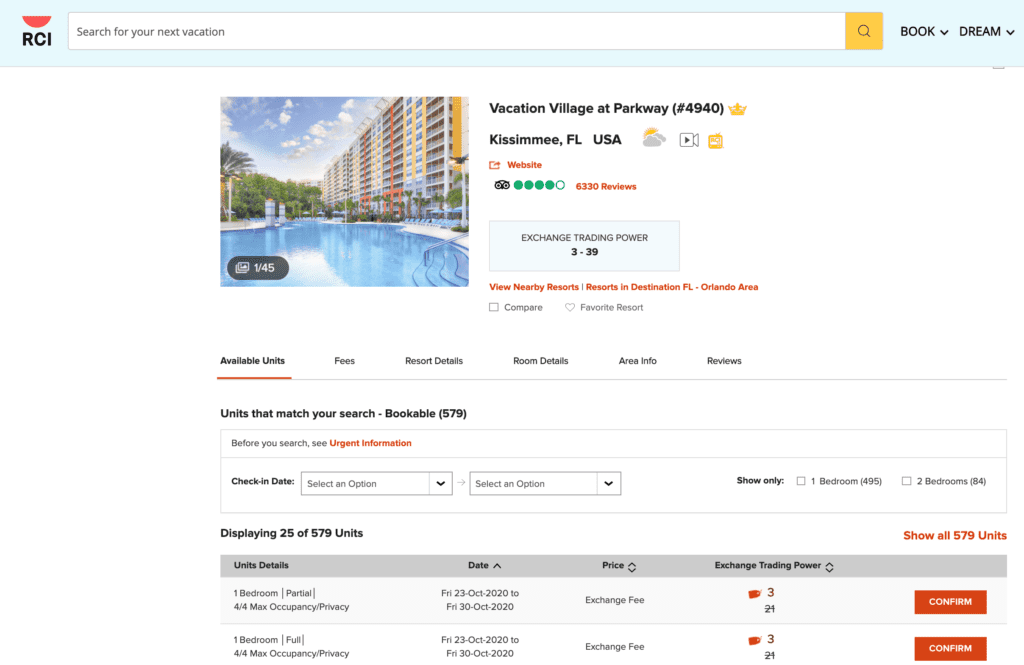

For this analysis, I’m running real resale listings through RCI (the world’s largest vacation exchange company) to see how many points of trading power they’d get for their associated annual Maintenance Fee. Since RCI divides timeshare ownership into two separate programs (it’s a complicated story why, and it’s not really relevant for our analysis), I’ll identify the best timeshares for sale for RCI Weeks owners and the best buy for RCI Points owners.

What about the purchase price when analyzing timeshares for sale you say? All the timeshare resale listings analyzed here are under $2,500. Over the course of a 20-year ownership, it is not a small purchase price that drives your value for money or even the $500 variance in closing costs from resort to resort. It is the annual fees and the annual trading power currency you can receive in return that gives you value year after year. That’s why this article focuses on these two elements of timeshare ownership and not finding Free or $1 resale listings.

If you’ve never heard of timeshare exchanges before, one of the most exciting things about owning a timeshare (besides the fact that I have no chores to do at my vacation property) is that you can trade for other timeshare vacations at 4,000+ affiliated resorts across 100+ countries via timeshare exchange companies. It’s like picking up your vacation home or ski condo and magically moving it around the world for every vacation!

What is the Best Place to Buy a Timeshare: RCI Points Program

Depending on what resort, and type of timeshare you bought, you might join the RCI Points program. This means that instead of vacationing at your “home resort” you can deposit your annual week with an exchange company and will receive 10,000’s of RCI points (your trading currency) to use for vacations all across the world. Pretty cool, right?!

When looking at timeshares for sale, a veteran of the RCI points program shared “A good rule of thumb would be to aim for 100 RCI points per dollar of maintenance fee (MF).” Well, let’s take a look at real timeshare resort resale listings to see what purchases would be a good value for the money in the points system!

| Resort/Unit Size | Maintenance Fee (MF) | Total Points | Points per MF Dollar |

| Summer Bay 1 BR | $993 | 53,000 | 53 points |

| Silver Lake 2 BR | $1,021.58 | 86,000 | 84 points |

| Vacation Village 2 BR | $970 | 93,400 | 96 points |

| Grandview 1 BR | $417.50 | 61,000 | 146 points |

| Woodstone @ Massanutten 4BR | $920 | 137,000 | 149 points |

| Regal Villas @ Massanutten 4BR L | $1050 | 178,000 | 170 points |

Down the road, if you ever wanted to enter a timeshare rental program or even shed timeshare ownerships, purchasing a week with high value would set you up for great rentals and allow you to sell without the need for an exit company.

Timeshares for Sale Bullseye: Regal Vistas High Season Purchase

So, the Grandview is close, but is not the Granddaddy of Timeshare Value! That being said, if you’re looking to buy a timeshare with low overhead, or to add to your timeshare portfolio, buying the above Grandview ownership for an annual financial commitment of $417 is still a really smart buy.

**I’ve been advised by a veteran timeshare owner that I should call out the potential of Maintenance Fee increases over time for large, newer resorts like Massanutten which are located in climates where the weather can create more maintenance needs and cost. Before purchasing a timeshare it’s important to look at the maintenance fee history of the resort to see the trend, and think about what climate it is located in and its weather-associated risks. As the true long-term “cost” of owning a timeshare is the annual maintenance fees, this is really the number and area to focus on pre-purchase. **

Buying a Regal Vistas at Massanutten Resort high season unit will give you the most value for money to use with an RCI Membership. In fact, this specific ownership provides more than three times the value of a Summer Bay one-bedroom ownership for the same maintenance fee. Now that’s purchasing timeshares with Dollars-n-Sense!

What’s interesting about Regal Vistas’ Weeks is that the maintenance fees for a high season or low season ownership at this timeshare resort are the same. So, the bullseye for securing years of future value for your dollar is to buy a timeshare resale listing in one of their seven high season weeks.

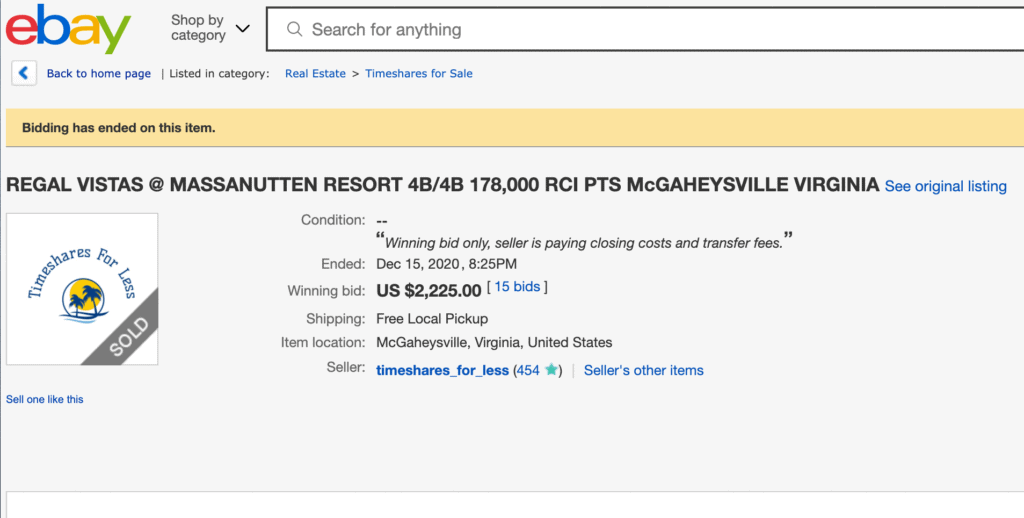

A high season Regal Vista resale listing is a rare sighting but can be done. In fact, one such ownership just sold on eBay for $2,250. That’s an amazing buy!

Exchanging Regal Vistas Timeshare Points

To give you a sense of what you can do with these 178,000 RCI timeshare points, you can exchange them for 8+ weeks of vacation. Whether it’s the mountains, beach, National Parks, or kid-friendly vacation clubs, you’ll be able to exchange your way to timeshare resort developments in top destinations. If you ask me, turning this much money into 8 week-long vacations in amazing condos resorts is a total life hack! When looking at timeshares for sale, there are so many vacation options than just the week that you’re buying.

If you’re interested in more ways to stretch your timeshare ownership check out “How to Hack Your Timeshare Ownership for Vacation Deals.”

What are the Best Timeshares for Sale: RCI Weeks Program

The RCI Weeks Program is the timeshare exchange I use when not renting or using my 2 bedroom unit. In this program, I receive 23 Trading Power Units (TPU’s) for each week deposited with RCI. When I bought these fixed weeks 15 years ago, I didn’t use value as the #1 purchase driver, but I’m pleased with the trading power we receive at $28.74 per TPU.

Let’s take a look at how that value compares to other resorts and answer: What resort is the best value for money for the RCI Week option? Here’s some real timeshares for sale:

| Resort/Unit Size | Maintenance Fee (MF) | Total TPUs | Dollar-Cost per TPU |

| Greensprings Resort 4BR Lockout Fixed Week | $1554 | 48 TPUs | $32.37 |

| Anchorage Resort Key Largo 1BR Fixed Week 51 | $600 | 23 TPUs | $26.09 |

| Vacation Village Weston 2BR Lockout | $947 | 37 TPUs | $25.59 |

| Grandview Triannual 1 BR | $417 | 17 TPUs | $24.53 |

| Kahana Falls Floating Week Studio | $650 | 45 TPUs | $14.44 |

Timshares for Sale Bullseye: Hawaii Independent Resort Purchase

While the Grandview triannual timeshare ownership is a super low-cost way to join the world of timesharing, a Kahana Falls one week purchase provides more value in the RCI Weeks Program. When buying for value for money these are two of top timeshares for sale that people consider.

People love triannual vacation club ownerships as the per-year financial commitment is very low. The Grandview in Las Vegas offers one of the lowest triannual offerings in the timeshare industry at $139 a year (or $417 every three years) and remains a really smart timeshare purchase. If you’re looking at timeshares for sale, it’s a savvy one to purchase.

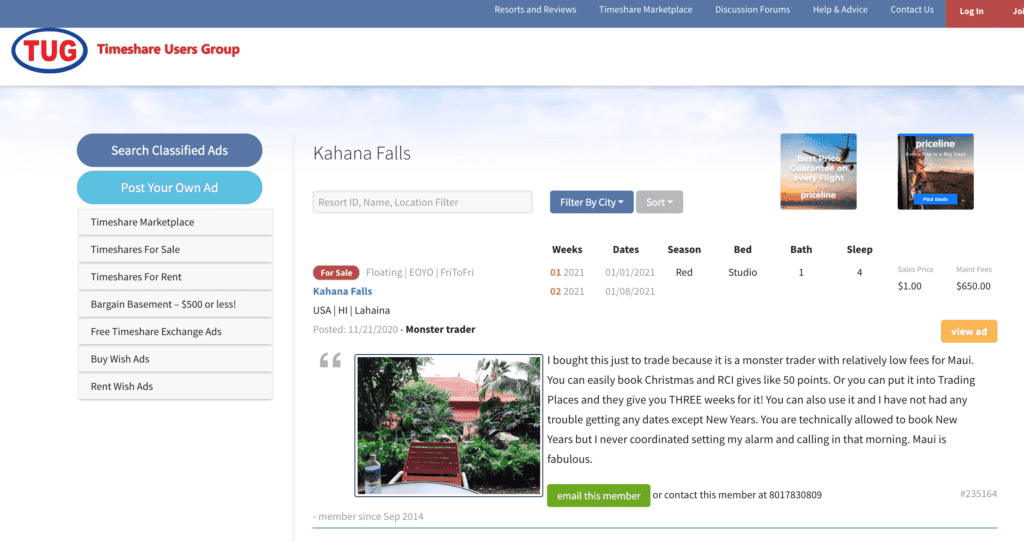

Exchanging Kahana Falls Trading Currency

This Kahana Falls floating week vacation ownership was advertised on TUG as a “Monster Trader” and the owner wasn’t exaggerating! She wants to timeshare exit some of her real estate in cities with complicated Airbnb rental regulations so she is giving this away. Even though I already own 13 timeshare weeks, I’m really interested in this free vacation club listing that provides 45 TPUs for $660 a year. Here’s a screenshot of real timeshares for sale on TUG:

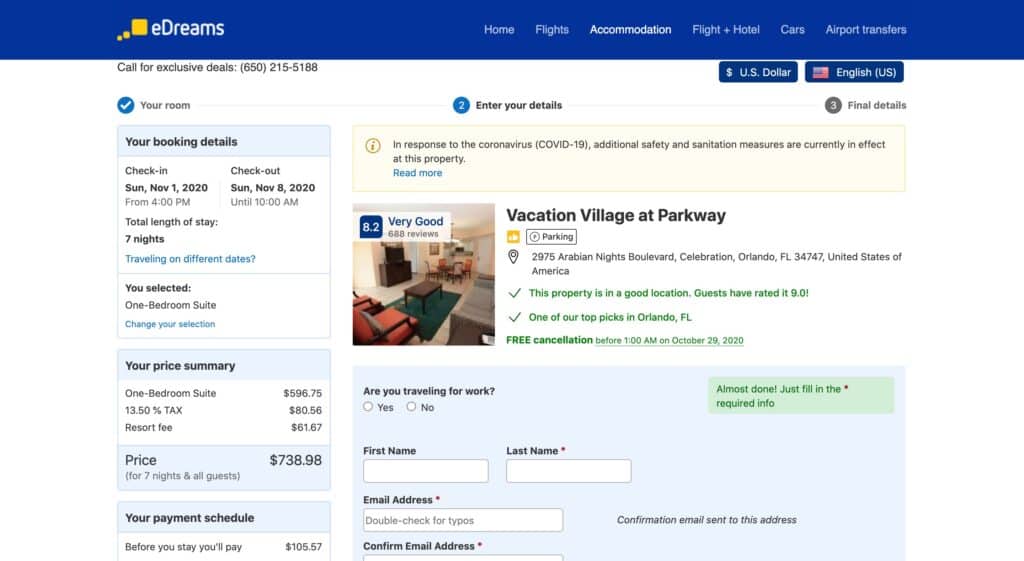

To give you an idea of how one could use 45 TPUs with the RCI Weeks Program, you could exchange for 15 timeshare weeks in a one-bedroom at Vacation Village Orlando.

A timeshare rental of a one-bedroom at this kid-friendly resort on a bargain hotel website runs $738 a week.

After including the exchange fees, you’d get it for 66% of the bargain travel site price. Who needs a vacation home in Florida with upkeep responsibilities when you could snowbird for the entire winter every year in a resort with 7 pools and loads of vacation club amenities at this price. You know where to find me in retirement!

Hawaii has always been a very expensive place to vacation, but staying in timeshares vs hotels makes it much more accessible. The average Hawaii hotel room rate is $330 a night, making this week-long condo cost of $660 a real deal! To sweeten the pot, many timeshare exchange companies offer bonus weeks if you deposit your Hawaii timeshare week with them. This means I could transform my $660 Hawaii week into two weeks of Hawaii condo accommodations. That’s only $88 a night taking into account exchange company fees. A-lo-ha!

Thanks for joining me today! If you approach buying timeshare properties or vacation club ownerships with ‘dollars and sense’ you will be setting yourself up to enjoy years of beautiful resorts for Motel 6 hotel room prices. Happy Timeshare Travels, ya’ll!